Oversupply of Airbnbs in the Southern Berkshires

Supply is outrunning demand in Massachusetts' mountain region.

I arrived in the Southern Berkshires two weeks ago to look at the real estate market. The region’s long-term prospects are attractive. It’s 2.5 hours to both New York City and Boston, it is home to a gorgeous mountain range, and has as a clutch of renowned cultural venues. It’s an unusual combination of natural beauty and prosperity. Short term rentals are popping up all over the region to dip into the bounty. The Berkshires have 25% more Airbnb listings than three years ago, and 6% more than last year.

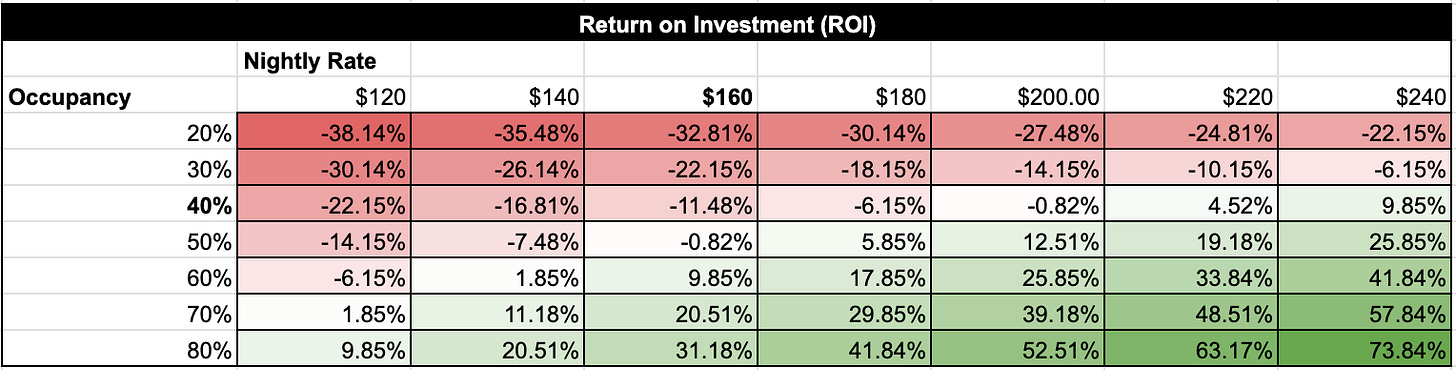

The rapid climb in supply is limiting occupancy rates and breaking the investment math. This is great news for local workers looking for housing, less so for yield hunters. Below is the math on a six bedroom Airbnb: 560 Stockbridge Road, Lee.

Airbnbs in the Lee area can expect a 40% occupancy at $160 / night / room. Average performance for this property would yield -11.48%. That’s a loss of $11,480 per $100,000 invested. A few assumptions in this model were a 6.5% mortgage, 25% downpayment, $28,800 in cleaning fees, and a 20% management fee. The occupancy expectation on this property would need to be 60% to attract serious investors. The full model is here.

This isn’t to say the Berkshire’s Airbnb volume will decline. There are over-housed folks warming up to the idea of renting spare bedrooms. The marginal cost of renting an unused bedroom is low, even lower for those that enjoy company. Suppliers with lower marginal cost win. Locals are beating investors on marginal cost. It costs investors $42,000 up front and $26,000 / year to deliver a new Airbnb room rental. It costs an over-housed local almost nothing. This marginal cost dynamic is why short term room rentals are a local benefit. New York City reached this same conclusion in their STR policy: full units are off limits but rooms are fair game.

There are 10% yield investments in the Southern Berkshires, but short term rentals are not currently one of them.

Informative. Look forward to seeing what market you visit next